The car insurance for college students blog 8433

The Best Strategy To Use For Non-owner Car Insurance- Can I Get Car Insurance Without A Car?

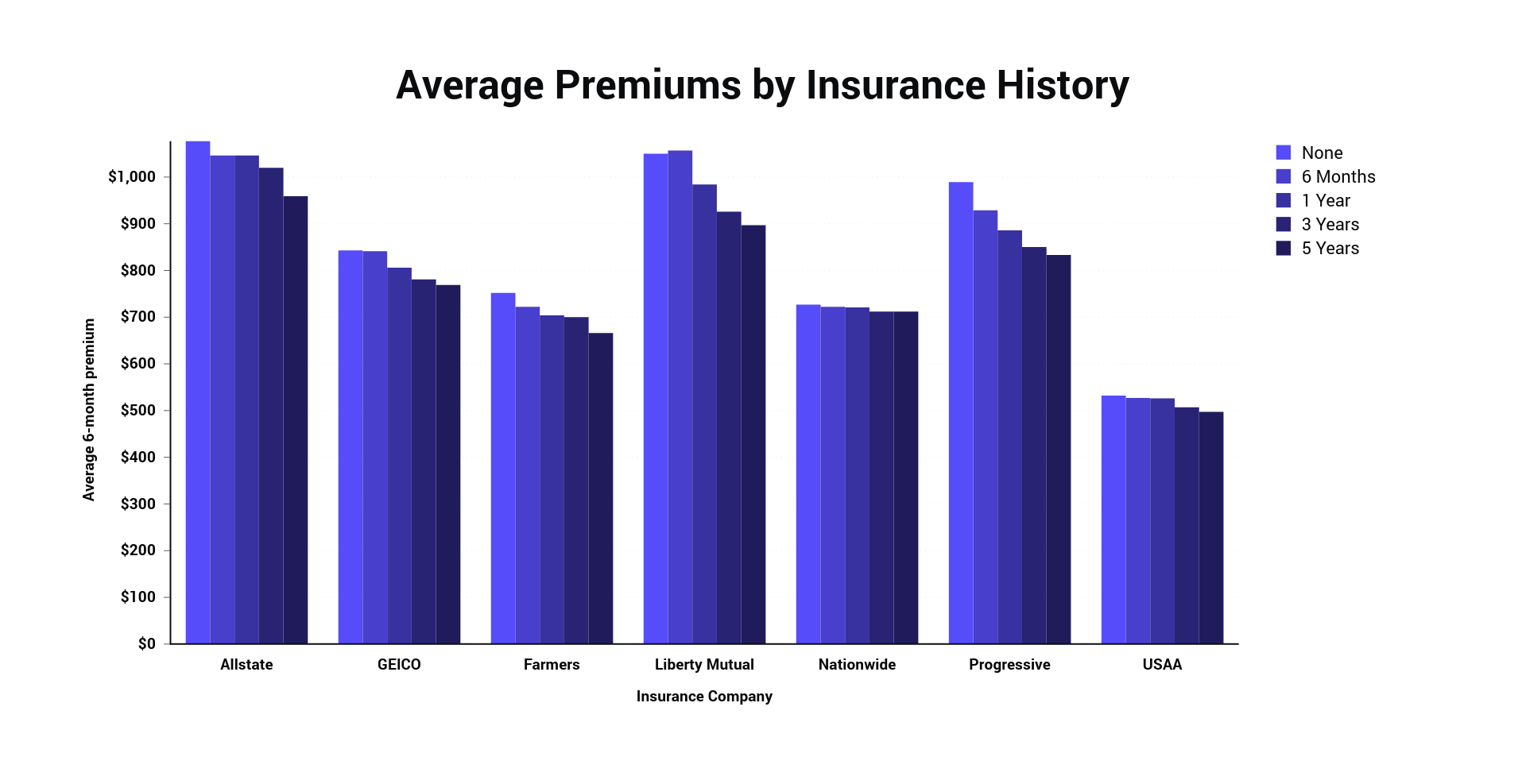

Constantly tell the reality about any traffic offenses you have actually received, because the insurance company will learn, and it will impact your premiums. Some insurance provider will not accept you if you did not have at least 6 months of prior cars and truck insurance protection, however that's not the case with The General.

Select ... Select ... OVERVIEW WHAT'S COVERED WAYS TO CONSERVE FAQ The Journey Starts Here With a Cars And Truck Insurance Coverage Quote It's fast and simple to get a cars and truck insurance quote. When you struck the roadway, feel great that you, your loved ones and your pockets are effectively protected. Let us fret about the threats of the road, while you take pleasure in the liberty of the ride.

Ways to Save on Vehicle Insurance coverage Where readily available, buying multiple policies such as vehicle and home insurance with the exact same company, maintaining a safe driving history and paying through electronic fund transfer might be manner ins which you can save cash on vehicle insurance. Bundling several insurance plan can result in premium discount rates - car insurance.

Associated Products Safeguard your house the method it safeguards you by picking the residential or commercial property insurance coverage that meets your needs - insurers. This liability coverage might exceed and beyond your car and house insurance policies to assist safeguard you from unexpected events. Occupants insurance can assist to cover more than your personal effects.

Select ... OVERVIEW WHAT'S COVERED WAYS TO SAVE FREQUENTLY ASKED QUESTION.

Is it better to acquire your automobile insurance coverage online or overcome a representative? That depends on your needs and what you're comfortable doing. In this short article, we at the House Media examines group explain where you can buy online car insurance and when you might be much better off calling a representative. business insurance.

Where to acquire cars and truck insurance online Almost every major insurer uses a method to get quotes for vehicle insurance coverage online, though some need you to contact a representative prior to you can settle your purchase. Lots of companies, however, enable you to finish the entire process on the web, from quote to acquire.

The Ultimate Guide To Guide To Car Insurance Information - Chase

The basic kinds of car insurance coverage consist of: Here are some steps to follow to get car insurance coverage online: 1 - perks. Get an online vehicle insurance coverage quote The initial step is to get a quote either through an insurance provider's site or by utilizing a totally free cars and truck insurance coverage quote tool like the one listed below.

Compare quotes After you offer the essential info, some sites might provide instant automobile insurance coverage prices quote that allow you to see the expense for the level of protection you select. Other companies might request your phone number or e-mail address and have a representative contact you with your quotes and options.

Select protection Insurance companies that permit you to acquire a policy online will assist you through the purchase process, which ought to be uncomplicated. You'll be asked to pick the protection you want as well as add-on options like roadside help or mishap forgiveness.

Your other option is to pay through a bank by supplying your routing number and account information. 5. Print your card Finally, print your insurance coverage card from house. Your insurer may likewise send by mail a card to you. Expense of online car insurance According to our rate price quotes, full protection car insurance coverage costs approximately about $144 monthly ($1,732 per year) for great drivers (insure).

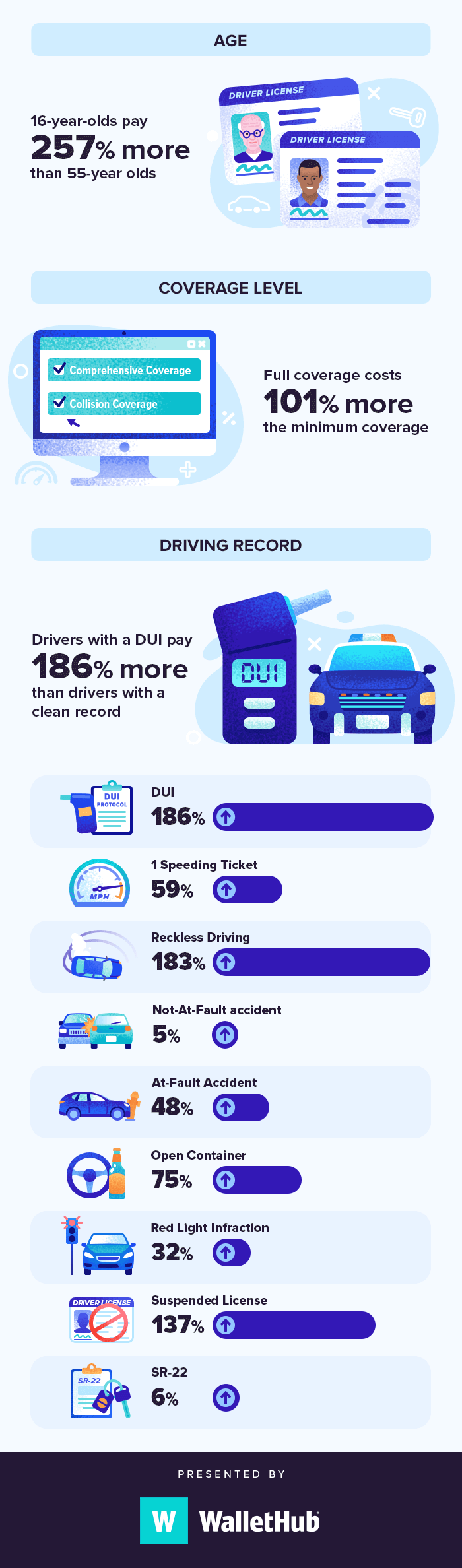

In our January 2022 cars and truck insurance study, we found 41% of participants had experienced a rate increase without an obvious cause. What affects the cost of automobile insurance? The cost of any auto insurance coverage will depend upon a number of elements, including your: Place Driving history Credit history (other than in California, Hawaii, Massachusetts and Michigan) Automobile Age Marital status Coverage choice Deductible Is it cheaper to buy insurance coverage online or through a representative? It is normally less expensive to buy cars and truck insurance coverage online, as there are no representative costs or markups.

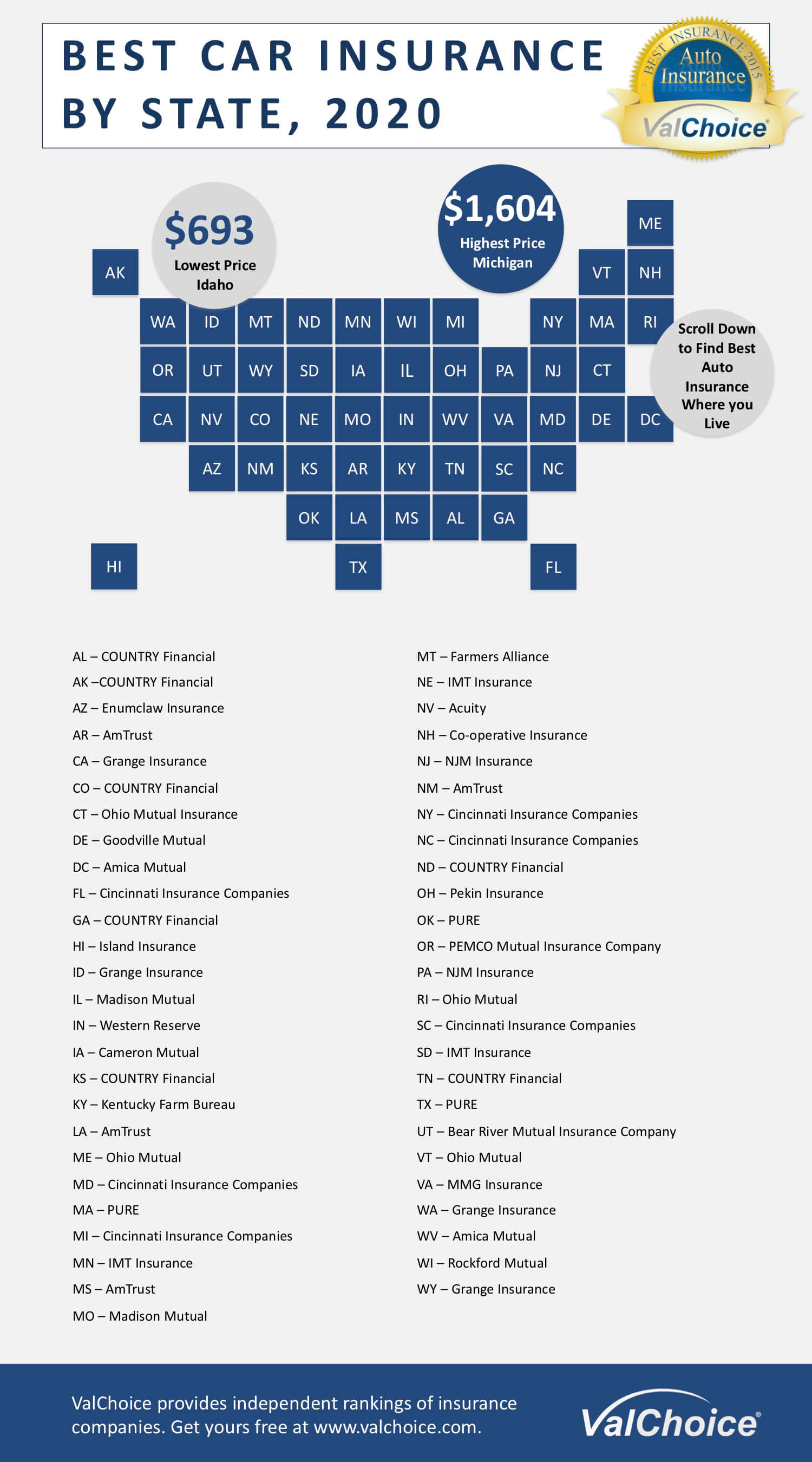

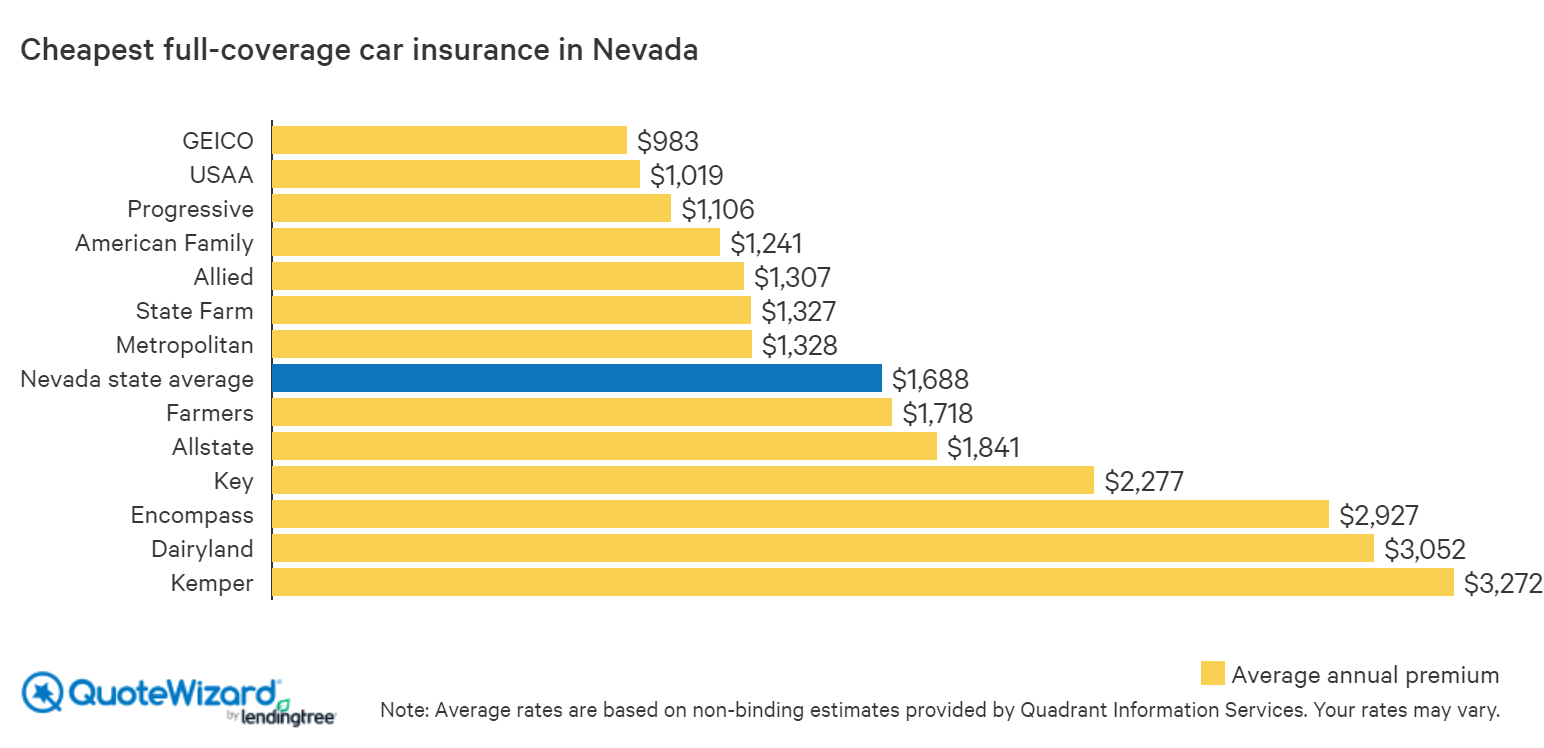

Agents may also assist you find car insurance discounts that you might not otherwise understand about. Automobile insurance coverage costs by state Even if you acquire automobile insurance coverage online, expenses can differ substantially by area. Here are annual and month-to-month car insurance coverage cost price quotes by state. Should you purchase vehicle insurance coverage online? You need to select your insurance company based upon which company provides the finest automobile insurance rates and protection for your needs.

Utilize the tool below to compare online cars and truck insurance prices estimate from top business in your area, or check out on to read more about two of our advised suppliers, Geico and USAA. Geico: Editor's Option In our industry-wide evaluation, we ranked Geico among the leading car insurance coverage suppliers in the nation (prices).

Getting The Pay Less For Auto Insurance - Credit Karma To Work

Discount rates like those for being a great driver (up to 26% off), being a good student (up to 15% off) and having several vehicles on your policy (up to 25% off) are only a few of the ways to conserve with Geico.

USAA: Low Rates for Military USAA scored the highest in every area in the J.D. Power Vehicle Insurance Coverage Research Study. The business is also understood for reliable claims service. It scored 909 out of 1,000 points in the, higher than all other providers. To be qualified for a cars and truck insurance policy with USAA, you need to be a member or veteran of the United States military or have a household member or partner that is a USAA member.

Completion outcome was an overall ranking for each service provider, with the insurance companies that scored the most points topping the list. Here are the aspects our ratings take into consideration: Expense (30% of total rating): Vehicle insurance rate price quotes produced by Quadrant Information Services and discount rate opportunities were both considered.

Automobile insurance is essential to protect you economically when behind the wheel.!? Here are 15 strategies for saving on vehicle insurance costs.

Lower automobile insurance coverage rates might likewise be available if you have other insurance coverage with the very same business. Preserving a safe driving record is key to getting lower cars and truck insurance rates. How Much Does Cars And Truck Insurance Coverage Expense? Automobile insurance expenses are various for every single driver, depending on the state they live in, their option of insurance provider and the kind of protection they have. vehicle.

The numbers are fairly close together, recommending that as you spending plan for a brand-new vehicle purchase you may require to include $100 approximately each month for auto insurance - insurance. Keep in mind While some things that affect automobile insurance rates-- such as your driving history-- are within your control others, expenses may likewise be impacted by things like state guidelines and state mishap rates.

Once you know how much is automobile insurance coverage for you, you can put some or all of these methods t work. 1. Take Advantage of Multi-Car Discounts If you obtain a quote from a car insurer to insure a single automobile, you might end up with a higher quote per automobile than if you inquired about insuring a number of drivers or vehicles with that business (cheaper).

All about Michigan $400 Car Insurance Refund: Here's What Drivers ...

If your child's grades are a B average or above or if they rank in the top 20% of the class, you might be able to get a great student discount on the protection, which normally lasts until your kid turns 25 - affordable. These discount rates can range from as low as 1% to as much as 39%, so be sure to show evidence to your insurance representative that your teen is a good trainee.

Allstate, for example, uses a 10% automobile insurance discount and a 25% homeowners insurance coverage discount when you bundle them together, so inspect to see if such discount rates are readily available and relevant. 2. Take note on the Roadway Simply put, be a safe chauffeur. This should go without stating, however in today's age of increasing in-car interruptions, this bears discussing as much as possible.

Travelers provides safe motorist discount rates of between 10% and 23%, depending upon your driving record. For those uninformed, points are typically assessed to a chauffeur for moving violations, and more points can result in greater insurance coverage premiums (all else being equivalent) (low-cost auto insurance). 3. Take a Defensive Driving Course Often insurance provider will provide a discount for those who finish an approved protective driving course.

Ensure to ask your agent/insurance business about this discount rate prior to you register for a class. After all, it's essential that the effort being expended and the expense of the course equate into a huge sufficient insurance coverage cost savings. It's likewise important that the chauffeur sign up for an accredited course.

4. Search for Better Car Insurance Rates If your policy will restore and the annual premium has increased noticeably, consider shopping around and obtaining quotes from completing companies. Every year or two it probably makes sense to obtain quotes from other business, simply in case there is a lower rate out there.

What good is a policy if the business doesn't have the wherewithal to pay an insurance claim? To run a check on a particular insurance company, think about inspecting out a site that ranks the financial strength of insurance coverage business.

In basic, the fewer miles you drive your cars and truck per year, the lower your insurance rate is most likely to be, so constantly inquire about a company's mileage limits. 5. Usage Public Transportation When you register for insurance, the company will typically begin with a questionnaire. Among the questions it asks may be the number of miles you drive the insured vehicle per year.

The Only Guide for How To Get Car Insurance In 5 Steps - Nerdwallet

Find out the precise rates to guarantee the different vehicles you're considering before making a purchase., which is the quantity of cash you would have to pay prior to insurance selects up the tab in the event of an accident, theft, or other types of damage to the lorry.

8. Enhance Your Credit Rating A driver's record is clearly a big factor in identifying car insurance expenses. After all, it makes sense that a chauffeur who has remained in a lot of accidents might cost the insurance provider a great deal of cash. Folks are sometimes amazed to find that insurance companies might also think about credit ratings when figuring out insurance coverage premiums.

Regardless of whether that's real, be conscious that your credit score can be a factor in figuring insurance coverage premiums, and do your utmost to keep it high.

Consider Area When Estimating Car Insurance Rates It's unlikely that you will move to a various state merely because it has lower car insurance coverage rates. When planning a move, the prospective modification in your automobile insurance rate is something you will desire to factor into your spending plan.

If the value of the car is just $1,000 and the crash protection costs $500 annually, it might not make good sense to purchase it. 11. Get Discount Rates for Installing Anti-Theft Devices People have the prospective to reduce their yearly premiums if they set up anti-theft gadgets. GEICO, for instance, provides a "prospective savings" of 25% if you have an anti-theft system in your car.

Vehicle alarms and Lo, Jacks are 2 kinds of gadgets you may want to ask about. If your main motivation for setting up an anti-theft gadget is to lower your insurance coverage premium, consider whether the expense of including the device will result in a significant enough cost savings to be worth the trouble and expenditure. auto insurance.

Speak with Your Agent It is essential to keep in mind that there might be other expense savings to be had in addition to the ones described in this article. That's why it typically makes sense to ask if there are any special discount rates the company provides, such as for military personnel or workers of a certain company.

The Best Guide To Root® Insurance: Car Insurance For Good Drivers

There are many things you can do to minimize the sting. These 15 tips should get you driving in the right direction. Keep in mind also to compare the best cars and truck insurer to find the one that fits your protection requirements and budget.

These consisted of cars and truck insurance coverage rates by state, insurance carrier and lorry producer, as well as the motorist's age, driving record, gender (where allowed), to name a few aspects. cheap car. This data might assist you approximate how much your automobile insurance plan may cost based upon your location and personal profile, and identify which automobile insurance coverage carriers best align with your budget plan and coverage requirements.

Because auto insurance coverage premiums are based on more than a dozen individual ranking factors, the real cost may differ for every motorist. Here are some essential truths about car insurance rates: Bankrate insight New York, Louisiana and Florida are the three most pricey states for cars and truck insurance coverage usually.

https://www.youtube.com/embed/FdQI4tBGWAM

Having a severe offense like a DUI on your motor car record could increase your automobile insurance coverage premium by 88% on average. Teen male chauffeurs may pay $807 more for automobile insurance on typical compared to teen female motorists.

The Definitive Guide for 10 Cheapest Cars And Suvs To Insure - Aarp

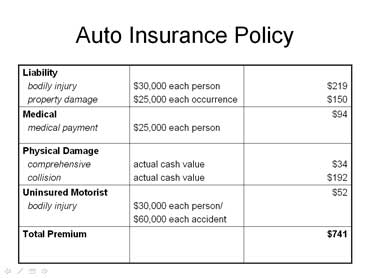

To find the finest cheap cars and truck insurance coverage alternatives it assists to understand how auto coverage works. A car insurance coverage includes 6 fundamental kinds of protection: Liability Protection: If you cause a wreck, this part of your car policy pays to fix the damage you caused both home damage and bodily injury to someone else - cheaper car.

These cover many of the scenarios you might get in as a driver and vehicle owner. In addition to your driving record, these aspects impact the cost of your protection: Credit rating There is a connection in between lower credit rating and higher instances of claims - liability. Age Data reveal that the youngest and earliest chauffeurs are involved in more wrecks than other chauffeurs.

Telematics Insurers collect real data about your driving practices to determine your threat of having a wreck. Vehicle Make and Model Some automobiles cost more to guarantee than others since they have higher repair expenses or tend to cause more damage in collisions. Automobile Age Considering that more recent cars would cost more to replace, policies for more recent automobiles tend to cost more (affordable car insurance).

It's based on the other underwriting elements we have actually currently gone over. Finest Low-cost Cars And Truck Insurance Coverage Frequently Asked Questions Who has the most inexpensive vehicle insurance coverage? Based upon our analysis, Geico is the insurer providing the most inexpensive rates. Do cars and truck insurance rates vary from state to state? Yes. With some companies they vary extensively.

Mishaps cost insurance coverage business money. insurance affordable. Someone with a clean driving record is statistically less most likely to have a wreck and can get lower premiums. In the majority of states, after three to four years, the effects of the unfavorable marks on your driving record will go away.

Every state has its own requirements and regulations for motorists, as do automotive financing and leasing companies. Not just is it a requirement, but it's something that will protect you economically if you are involved in a mishap. The last thing you want to fret about is having to pay countless dollars for car repair work, home damage, and even medical expenses if you remain in a mishap.

Additionally, the Geico agent rates for a profile of a 25-year-old chauffeur in the research study are rather a bit lower than the rates used by other automobile insurance business, as are the research study rates for profiles consisted of in the research study with one accident on their records.

Fascination About New Cars, Used Cars For Sale, Car Reviews And Car News

The representative rate for a policy is $1212. When using many of the chauffeur profiles we utilize, Travelers stays in the third-place position, although for numerous profiles, it does drop to fourth location, enabling State Farm to move into 3rd (laws). According to our analysis, Nationwide is the seventh-cheapest business on the list.

Although Nationwide's protection is more costly than the majority of the other companies on the list, this business does offer some of the most affordable study rates for drivers with low credit history. Of the companies on this list, the representative insurance rates from Progressive are the fifth most affordable. Based on the motorist profiles utilized, the study rate is $1308 each year.

More Pricey Car Insurance Provider, In our analysis, the automobile insurance coverage rates offered by Farmers are significantly higher than average. The research study rate is $1538 annually, making Farmers the second-most expensive company in our study. We found that State Farm is the second-most pricey total amongst the 9 major automobile insurance provider on the list.

It is nearly $900 above the rate from USAA, the most inexpensive automobile insurance coverage company in our research study. Regional and Local Companies, When comparing vehicle insurance coverage rates, it's essential to be aware that not all business provide insurance coverage throughout the nation.

This ideal customer would permit the insurer to earn a profit due to the fact that they are most likely to pay their premiums without making expensive claims on their policy. How to Lower Your Rate, If you wish to lower your insurance rates, look for discount rates through the different insurer. You can ask your insurance coverage representative about what discount rates are available, as the business might provide discount rates that you are eligible to receive but are not taking benefit of on your policy.

When requesting auto insurance estimates from numerous providers, ensure to ask for all discounts that are available to you - cheaper cars. Traffic Offenses and Insurance Rates, When a driver profile has one speeding ticket, the research study rates begin to go up. This correlation is due to the truth that chauffeurs who speed are most likely to be associated with mishaps.

If a chauffeur profile has a mishap, the rates increase a lot more. USAA is still the lowest-priced option for chauffeurs with an accident, but their rates increase by about $320 each year over a motorist without an accident on their record. The typical increase in the study rates for drivers with a mishap throughout all business on the list is $300 each year.

The Only Guide for Dairyland® Auto - Cheap Car Insurance

This is since motorists who drive while under the impact are at an extremely high danger of causing a mishap. The motorist profile utilized in our study with a DUI showcases how particular insurance business punish this violation more than others. Although Geico is the second-cheapest overall in our analysis, the rates for the profile with a DUI are some of the greatest in the research study - liability.

The profiles utilized in our research study with great credit received an average rate of $1306 each year, while the typical yearly rate for profiles with poor credit was $2318. Info and research study in this short article validated by ASE-certified Master Service Technician of. For any feedback or correction requests please call us at.

You may have the ability to discover more details about this and similar content at.

How Does Automobile Insurance Work? Once you agree on a cheap cars and truck insurance coverage policy and its coverage (and exclusions), you will begin paying your budget-friendly monthly premiums.

This can be done so by acquiring free cars and truck insurance coverage quotes. A Quote is used free of charge by insurance coverage business and provides a quote for how much your auto insurance coverage will be. An Automobile Insurance coverage quote is identified by a variety of individual aspects, like where you reside and your automobile type.

Paying your regular monthly premiums will keep your policy active for the set term, typically 6 or twelve months. When the term is up, you will have the choice of restoring or discovering a new insurance company. Inexpensive Car Insurance Near Me, This is why Insurance coverage Navy is happily providing cheap car insurance coverage rates for all 50 states online and over the phone - cheaper.

Lower Your Vehicle Insurance Rates Some things about your insurance rates can be customed while others you can't manage. Thankfully, there are a number of savings and discounts readily available that can decrease your premiums.

The Best Strategy To Use For 5 Cheapest Car Insurance Companies [April 2022 Guide]

Look both in your area and nationally. When you find an enticing low-cost vehicle insurance coverage quote from a business, make sure you take some time to compare the different car insurance coverage that are offered. A great rate for an insurance quote does not equivalent good protection. You wish to make sure you will in fact be secured in case of an accident.

Less expensive automobile insurance coverage with better coverage is possible with Insurance Navy. Better Your Credit Score, Improving your credit report might take some time however might be actually worth it. Drivers with a poor credit history are paying more for automobile insurance premiums - affordable car insurance. Drivers can take some actions to improve their credit score, such as paying their expenses on time or using a secured charge card.

Automobile Insurance Discounts You ought to definitely take benefit of any discount rates when you can. Don't be afraid to ask your insurance coverage agent about discounts even if they are not noted on the insurance company's website - trucks. Representatives will be important resources especially considering that there may be more discounts you are unaware of.

If you chose a higher coverage limitation, you might try decreasing it for more inexpensive rates. You want to make sure that you are not going below your state's mandated minimum protection. You likewise want to ensure you still have adequate coverage that you will actually get defense in a mishap.

By doing so, you might get more affordable rates and more discount rates on your car insurance quote. Not every company provides this kind of homeownership discount rate, so ensure you do some research study if you have an interest in getting the most cost effective rates and greater discount rates. Typical Expense For Automobile Insurance Coverage There are a great deal of elements that enter into figuring out every driver's rate - auto.

Budget friendly rates and greater automobile insurance discount rates are identified by the following approach: How where you live impacts auto insurance coverage estimates Not just does your state and its mandatory insurance coverage minimum protection affect your rates, but even something as particular as your zip code can be thought about. If you live in an area with a greater crime or mishap rate, your quote will be higher.

When you have a high credit report, you most likely pay your costs on time which is appealing for an insurance coverage company. cheap car insurance. In turn, you will be used more cost effective rates and your quote will be lower. However, if you have a poor credit report, you may pay a higher price for car insurance protection.

Farmers Insurance: Insurance Quotes For Home, Auto, & Life Can Be Fun For Everyone

This is due to the truth these teen and older drivers tend to get into more accidents (liability). When it pertains to gender, males see higher rates than ladies as they have a practice of engaging in risky habits. Insurance providers can even take your marital status into account when computing your quote.

Vehicle type and car insurance prices quote Some cars, trucks, vans, and SUVs are just more expensive than others to insure - cheap insurance. This can be due to the schedule of parts and the cars and truck's security functions. What has actually been laid out above are just some of the factors that will be considered when searching for cheap automobile insurance quotes.

How Much Insurance Does Your Vehicle Required? Protection limitations are the maximum amount of money your insurer will pay in the occasion of a claim. For example, if your vehicle has $30,000 worth of damage but your coverage limitation is set at $20,000, there is $10,000 worth of damage not covered.

You need to carry a minimum of the state-mandated minimum coverage, however you can constantly buy greater limits if you feel you require more defense (insure). Mishaps can be really pricey, but do not sacrifice protection for lower rates. It is not advised that you strictly rely on the state-mandated insurance minimum protection and not also purchase comprehensive insurance.

A car insurance coverage policy is an agreement between the insurance policy holder, usually the automobile's primary driver, and the insurance coverage company. insurance company. The insurance provider consents to safeguard the policyholder versus financial losses described within the policy (this is a crucial note since if it's not in the contract, insurance provider will not cover it).

Coverages are those conditions outlined clearly in the policy, where your insurance business will payment. And the payment is the quantity up to which an insurance service provider will make you whole.

If the insured stops paying premiums, the insurance coverage service provider will stop coverage immediately. If the uninsured motorist triggers an accident while driving, then they are personally on the hook for the costs of damages.

The 3-Minute Rule for Best Cheap Car Insurance Companies For April 2022 - Cnet

State hi to Jerry, your new insurance coverage agent. We'll call your insurance provider, examine your current plan, then find the protection that fits your requirements and conserves you money.

To evaluate these service providers, we took a look at average rates, but also focused on each company's coverage alternatives and discounts and finished with a review of monetary strength ratings and client satisfaction ratings. The five business on our list inspected package in each of these classifications. Based on our evaluation, the best low-cost automobile insurer are Erie, American Household, Geico, Auto-Owners, and USAA.

https://www.youtube.com/embed/ktHT12eJLPc

A++ AM Finest Rate AM Finest rates insurance coverage service providers creditworthiness. Pros, Adjustable protection, Highly-rated claims managing and consumer satisfaction, Range of discounts, Cons, Should work through an agent, No online quote tool, Types of Coverage Offered, Roadside support, Space insurance coverage, Rental car repayment, Decreased worth, Extra cost, Collision coverage advantage, Common loss deductible, Personal auto plus bundle, Discounts Available, Multi-policy, Life multi-policy, Paid-in-full, Payment history, Advance quote, Paperless billing, Multi-vehicle, Security features (anti-lock brakes, anti-theft system and air bags)Favorable loss, Good trainee, Trainee away at school, Teen driving monitoring USAA Best for Military-Centric-Options Why we chose it USAA offers affordable vehicle insurance coverage rates and outstanding client service to members of the military, their partners and children.

The smart Trick of What Is Liability Car Insurance Coverage - Belairdirect That Nobody is Discussing

physical injury responsibility cars and truck insurance coverage, or, covers the clinical costs of the victims if you're found to be at-fault in a mishap (cheap car). It likewise covers loss of earnings if the injuries maintain the individual from working (affordable). All states, other than Florida, need chauffeurs to have BI insurance coverage.

The limitations for each component differ by state, as well as your automobile insurance coverage agent can clarify the minimum needs. Expenses not covered by a responsibility insurance coverage plan While obligation insurance coverage extends to residential property damage and also medical expenses of others hurt as a result of an at-fault crash, it does not cover the losses of the person that created the crash.

- Accident insurance is created to cover damages to the insurance holder's car in case of an at-fault accident. This kind of insurance coverage is needed by lenders if the vehicle is under a funding or lease - insured car. Once the car is settled, it ends up being optional but is still suggested for those that drive cars with excellent market price.

- Bodily injury per crash is the overall quantity that a policy will certainly cover for injury costs. As an example, in a situation where the plan is packaged 25/50, the policy might pay as much as $25,000 each but will not cover even more than $50,000 per crash. In serious crashes, this can result in the insurance holder dealing with out-of-pocket expenses (vehicle insurance).

While each state has actually a mandated minimum, it's always a great suggestion to buy more coverage. A lot more coverage can safeguard you as well as your properties and also minimize the amount you have to pay out-of-pocket in the situation of an accident. cheaper car. More responsibility protection implies much less obligation If you're still undecided concerning how much liability vehicle insurance policy coverage to purchase, it's worth thinking about that (auto).

Some Known Questions About What Does Liability Insurance Cover? (2022 Guide And Cost).

When you acquire obligation vehicle insurance policy, make sure to consult with your agent as well as identify what the appropriate quantity of coverage need to be. Insurance policy carriers often have minimal recommendations that satisfy state as well as neighborhood statute needs, however you can likewise select even more protection, and this is one case where it's far better to be risk-free than sorry. car insurance.

/GettyImages-sb10069770n-003-b3161baf08bb483c8d11603532abcbdc.jpg)

Residential property damage liability coverage spends for any damage done to one more individual's residential or commercial property, or loss of that property, in a covered crash where you are at-fault. In this example, the optimum amount that your plan would certainly pay is $25,000.

Every state that mandates auto insurance policy requires motorists Additional reading to have a minimum quantity of liability coverage, It's a good concept to purchase even more obligation insurance policy than just your state's minimum, so you're not on the hook for paying 10s of thousands of bucks out of pocket after a crash, If someone borrows your vehicle, your obligation protection also includes them - cheap car insurance.

Bodily injury responsibility insurance coverage, Bodily injury obligation insurance policy covers the price of the other motorist's injuries if you're in an at-fault crash. That means if you cause an auto accident, physical injury obligation insurance would certainly secure you versus the victim's claims for costs after the crash, such as their medical costs, lost earnings, discomfort and suffering, and also sometimes legal fees associated with injuries.

Property damage responsibility insurance coverage, Residential property damage responsibility coverage pays for the damage you create to somebody else's building with your car (insurance). Usually, building damages obligation insurance policy covers repair and/or substitute for damage you trigger to the other person's lorry, however it can additionally spend for damages to a home, structures, lampposts as well as telephone poles.

Some Known Incorrect Statements About Florida Insurance Requirements

** Rather than automobile insurance, Virginians can select to pay the Virginia DMV $500 to legitimately drive on public roadways (dui). This charge does not cover you in case of an accident, which means you'll get on the hook financially for paying for any type of mishaps that you trigger - cheap. What is no-fault liability automobile insurance policy? In "no-fault" states, there is no demand to establish who was at mistake for an accident to receive payments for injury cases.

Regularly asked concerns, What is the difference in between responsibility insurance policy vs. full protection? Liability insurance is called for in many states, and it covers the expense of building damages and also bodily injury to the other chauffeur and also their lorry if you're at mistake for an accident. Some vehicle drivers choose to get just responsibility insurance, in order to meet their state's demands.

Responsibility coverage is an essential insurance security. Physical injury and also home damage obligation insurance coverages give settlement for injuries to others, as well as for the damages your vehicle does to an additional individual's home if you cause a mishap. What Does Obligation Automobile Insurance Cover? If you are located responsible for creating damages as a result of a crash, this insurance coverage may pay up to the restriction you select, and it can offer a lawful protection if you're filed a claim against. perks.

The complying with expenditures are among the kinds of damages that may be considered: Health center and also medical bills Shed wages Discomfort and also enduring Recovery solutions In-home healthcare solutions Obligation protection supplies essential protection for chauffeurs and also a lot of states need vehicle drivers bring a minimum quantity of liability insurance coverage. Most states need chauffeurs to lug automobile liability insurance - dui.

>> SPEAKER: Bodily injury obligation protection - you might have listened to of it yet what is it? Picture this, you're driving to work, on the method you get into an accident with another automobile lugging three people (insurers). That's what physical injury liability insurance coverage is for.

Examine This Report about Liability Only Car Insurance - Coverhound® - Insurance ...

One - your lawful protection. As well as two if you're located responsible for problems up to the policy limit. right here's one more crucial thing to remember. If you're located responsible for an accident, your web well worth could be at risk. The even more properties you have, extra insurance coverage you might desire. cheap.

For even more solutions, go to [sonification] What Is Bodily Injury Responsibility as well as What Does It Cover? Physical injury obligation insurance generally covers the costs related to injuries you caused to other people, as much as your policy limit, in a protected mishap. Protection can also pay for a lawful protection if you're taken legal action against for that accident (insurance).

https://www.youtube.com/embed/GkJEQWGy0BI

Nobody is wounded but the various other cars and truck is damaged. That's what property damages liability insurance coverage is for - your insurance coverage provides for a number of essential things: One, damages to the various other person's car, if you are in charge of the accident approximately your policy limitation as well as 2, to your legal protection.

The 15-Second Trick For Top 9 Which Of The Following Affects One's Car Insurance ...

The personal attributes of the motorist. What triggers vehicle insurance policy premiums to raise? Chauffeurs that have a crash or relocating infraction (speeding, DUI, etc) on their electric motor lorry document are even more of a danger for automobile insurance companies, resulting in greater vehicle insurance policy rates.

low cost auto cars insurers credit

low cost auto cars insurers credit

Prior to you buy an automobile, compare insurance policy costs. Minimize coverage on older cars and trucks. Exactly how long does an auto mishap remain on record?

insurance vans accident cars

insurance vans accident cars

Is automobile insurance policy every month? Month-to-month repayment strategies for vehicle insurance normally come with an installation charge to cover the cost for the company to take care of 12 payments each year instead than one.

low cost auto car liability insurance companies

low cost auto car liability insurance companies

Who is more affordable than Geico? State Farm is the most effective choice for the majority of drivers searching for the most budget friendly cars and truck insurance coverage - auto. The prices State Ranch offered for a full protection policy were $427 more inexpensive per year than Geico's, as well as were even more affordable than those from Progressive, Allstate or Farmers.

What is the best car insurance for a 20 year old? It's real that auto insurance drops with age (generally speaking).

Some Of How Credit Scores Affect Car Insurance - Nationwide

In 2018, we exposed 21 days was the optimum time to acquire your auto insurance. Does cars and truck age affect insurance policy? Age influences cars and truck insurance rates since it's a sign of a vehicle driver's risk to an insurance provider. Youthful vehicle drivers are statistically extra most likely to enter a vehicle accident than older, more experienced motorists.

risks auto insurance vehicle insurance companies

risks auto insurance vehicle insurance companies

At what age does auto insurance go down for women? Gender does not impact cars and truck insurance premiums.

Is vehicle insurance less expensive for females? Rates rise and fall based on age, as well as the insurance policy firm.

Without insurance motorist insurance policy, to shield an individual as the plan owner, paying if they are the sufferer of a hit-and-run or an accident brought on by an uninsured or underinsured chauffeur. While this kind of insurance coverage is not called for in Iowa, it is highly urged for your protection. Factoring the Price of Car Insurance Premiums If you are looking for cars and truck insurance policy, we at center International are positive we have the understanding of the Dubuque location as well as the neighborhood existence required to finest help you. perks.

Credit report: insurance provider look at credit history in computing specific danger. cheap car insurance. With a history of debt or late payments, one's credit history will certainly be lower, which increases the expense of your insurance premiums. Deductible framework: the degree of insurance deductible is an easy means to reduced insurance policy premiums.

4 Easy Facts About 25 Factors That Affect Your Car Insurance Rate - Nerdwallet Shown

Packing cars and truck insurance coverage with various other items from the exact same carrier, such as home insurance policy, is one more method to reduced expense (cheap auto insurance).

Some insurance providers provide accident forgiveness, which enables you to have one case filed against you due to an at-fault mishap without a premium hike. However, you have to pay added for this kind of insurance coverage. credit. You should learn from your auto insurance policy agent if you can purchase crash forgiveness insurance coverage.

In some situations, an insurance coverage provider might bill you greater costs if they have actually paid out even more than $500 or if you have actually made numerous detailed insurance claims (insured car). Usually, you'll see your costs increase after the age of 70.

According to Price Estimate Wizard, an unjust increase in costs can happen if your insurance coverage company makes a decision to alter the concern of your credit ranking. They may offer recommended prices to drivers with higher credit rating. While not every state permits this, those that do can create troubles for some insurance policy holders.

If you have a low credit report rating, it can negatively impact your car insurance policy rates. If your credit report score has actually boosted, you may not see any type of change in your most current premiums. High-Risk Areas, If you reside in an area where vehicle drivers commonly make automobile insurance policy cases, you'll likely face greater insurance policy prices, states Car and Driver.

The Best Strategy To Use For 10 Key Factors That Affect Car Insurance Rates - Wallethub

Your auto insurance company gathers information regarding threat variables that influence your car insurance coverage rates from the quote type you complete. Behind the scenes, they use their algorithms to make a notified hunch on just how much danger you posture and come up with a quote. The safer you seem, the less you'll spend for automobile insurance.

If you obtain a high quote, it's likely that one of the data factors has indicated you're riskier to insure. It can also be due to the fact that the insurance coverage provider utilizes a premium estimation technique that does not prefer your individual information. Particular risk variables might not be obvious, such as your credit report.

You may have the ability to discover even more info about this and also comparable material at piano. io.

How can my credit score insurance rating benefit me? A credit-based insurance coverage rating allows insurance providers to quote the fairest, most ideal rate for every single client - liability. About fifty percent of our existing consumers pay a lower premium based upon their credit report. Does a great debt rating result in an excellent vehicle insurance rating? It's an apples-to-oranges comparison, so not truly.

What is an amazing life scenario? At Nationwide we value our consumers. We have a remarkable life scenario process that uses in all states. If your credit details has been directly affected by among the complying with occasions, you might receive reconsideration of your costs. Any type of catastrophic occasion stated by the government or a state government1 Total or various other loss that makes your home uninhabitable1 Divorce or dissolution of marriage Fatality of a spouse, child or parent Severe health problem or injury, either to you or to a prompt relative Short-term loss of employment for three months or more, if such loss is because of spontaneous unemployment Armed forces release abroad Identity theft If you have any kind of concerns concerning credit scores as well as just how it can affect your insurance coverage prices, feel free to call your Across the country representative any time.

Top Guidelines Of Planning To Renew Your Car Insurance? Here's Why It's ...

Have you created road crashes in the past? Did you ever get website traffic tickets from enforcers? If the response to both inquiries is yes, then chances are you require to pay even more costs when contrasted to others. Insurance provider will most likely take a look at your driving background for the past 5 years, and if they see website traffic offenses, at-fault accidents, and drunk driving conviction, you might have a difficult time searching for the right insurance coverage for you.

If you are eager to wait, then you require to enhance your track record prior to availing one.

Your Credit rating Your credit rating can have a significant influence on what you pay for car insurance. A poor credit scores rating implies that you are a higher danger, and it is likely that you will certainly pay more in costs. Individuals with bad credit rating also have actually an enhanced opportunity of getting rejected.

There are a few things that you could do to make sure that you're getting the finest bargain on vehicle insurance: 1. Shop around for quotes This is the most essential point that you can do when you're looking for automobile insurance policy - insure.

There are lots of contrasts. When purchasing a car, you need to see to it that you are covered. This is why you need to know what kind of insurance coverage is appropriate for you. affordable car insurance. You might be spending cash on insurance coverage that is not needed, or worse, not covered if something occurs while you are driving it.

Not known Incorrect Statements About What Factors Affect The Cost Of Travel Insurance?

Sex Ladies are safer drivers than men and pay less for their auto insurance protection. It is crucial to keep in mind that the cost of auto insurance differs based on lots of variables. affordable.

If you have had one or even more of these occurrences, expect your costs to increase. What's even more, if you have been at mistake for a mishap, there are cases where you may no more have the ability to obtain cars and truck insurance coverage in all. The 2nd factor is Costs can be affected by numerous different factors.

The top quality of your job: If you're not placing in the time, then no one will certainly pay for it. No one has time to arrange via the waste, as well as if you're not providing them anything to read, they will not read anything at all.

insurance companies dui cheap insurance cheaper

insurance companies dui cheap insurance cheaper

They pay because they desire to support you. The author of one of our add-ons is constantly thankful to the first 10 customers in his subject on the discussion forum he provides them useful bonus offers.

This is something we're trying to figure out at the moment, but we have actually been evaluating it by considering historical information (affordable). Not a lot has altered because in 2014, however we are doing some work with creating an extra regular rates model. We'll with any luck have some responses in another message quickly.

Getting The Which Of The Following Affects One's Car Insurance Premium Apex ... To Work

According to the very best car insurance provider in the country, the 3 crucial factors are: Your age: The younger you are, the more probable you are to be included in motor vehicle crashes. This is why most vehicle insurance coverage companies bill a whole lot more for individuals under 20 Go to this site and also individuals over 65.

If you stay in an area where many accidents happen, your costs will certainly be greater than those of somebody who stays in a much safer area. The type of cars and truck you drive, the variety of miles you drive, your sex, and your credit report are all aspects that affect your auto insurance coverage costs.

https://www.youtube.com/embed/877sf5q2FJA

You will certainly additionally pay much less if you install winter tires and also guarantee that you have appropriate liability insurance policy. You can likewise conserve cash on automobile insurance by guaranteeing several automobiles on a solitary plan or including an extra chauffeur to the policy. Added vehicle drivers on a policy often tend to enhance costs by concerning 5% for every extra chauffeur listed In the state of California, the main consider determining your insurance coverage costs are age, driving experience, where you live and also the kind of automobile you drive.

Facts About Types Of Car Insurance Coverage Uncovered

what does car insurance cover

what does car insurance cover

Contrast quotes from the leading insurance coverage companies. What Is Obligation Cars And Truck Insurance Coverage and What Does It Cover?

If you are hit by somebody else, and it's their mistake, their obligation insurance coverage will cover damages to your automobile as well as your clinical bills. There are two sorts of responsibility insurance: Physical Injury Liability, Bodily injury responsibility covers the driver as well as owners of the various other vehicle if you create an at-fault accident causing injuries. car.

Physical injury responsibility covers clinical costs, discomfort and suffering and salaries shed by the other person as an outcome of not being able to function while recouping from injuries. Building Damage Obligation, Residential or commercial property damages obligation insurance policy covers damages to the various other person's residential property, typically their vehicle, yet it can include things inside the vehicle - insurance companies.

The last 50 describes the quantity of residential property damage obligation per accident, which would certainly likewise be $50,000. Remember that physical injury liability is each, while building damage responsibility is per accident. If you hit 3 people and also 3 cars and trucks in the very same accident, your insurance policy will certainly cover you for approximately $100,000 for the bodily injuries of the individuals you strike ($100,000 optimum) as well as just up to $50,000 for all three of the automobiles.

The Single Strategy To Use For Car Insurance Coverage Types - State Farm®

If you add collision as well as extensive insurance coverage to your plan, you and your car will certainly be covered in a crash if you're at fault. This makes the added cost of the insurance policy worth it to many people. Accident will cover damage that happens from striking something, and comprehensive covers damages from burglary, weather, animals (such as striking a deer) and vandalism.

what does car insurance cover

what does car insurance cover

Some states additionally call for without insurance vehicle driver protection (), underinsured driver coverage (UIM) as well as personal injury protection (PIP). Regardless of your state's demands, you need to have responsibility insurance coverage or really deep pockets, as it's versus the regulation in a lot of states to drive without obligation coverage. New Hampshire doesn't call for responsibility insurance policy, but they do need drivers to prove they have some means of monetary duty if they trigger a mishap.

Susan would certainly after that be on the hook to pay the added $22,000 not covered by her liability insurance coverage. What Is Not Covered by Obligation Insurance Coverage?

Without insurance driver protection (shields you if somebody with no insurance hits you). Underinsured driver coverage (covers you if you're hit by somebody who doesn't have sufficient insurance coverage).

The smart Trick of Auto Insurance Shopping Guide - Illinois.gov That Nobody is Talking About

Below are several of one of the most often asked inquiries concerning responsibility insurance coverage. Broaden ALLDoes responsibility insurance cover theft? No, responsibility does not cover burglary. Thorough insurance will cover your automobile if a person steals it or get into it and also damages it in the process. Comprehensive also covers weather-related damages as well as vandalism.

If you have a financing on the lorry or lease a lorry, the finance firm is giving you a funding with the vehicle's price as security. If you only get obligation insurance coverage and also amount to the auto, it's unexpectedly worth much less than the quantity they lent you, and also they have no other way to recuperate that cash - affordable auto insurance.

Does liability insurance cover my car if I'm not at fault? If you're in an accident as well as the various other individual is clearly at mistake, their obligation insurance need to cover your automobile's damage.

Does obligation insurance coverage cover my cars and truck if I am at mistake? Responsibility shields anyone you hit in an accident. It doesn't cover your clinical costs, damage to your automobile or various other losses you experience. cheap car insurance. You will certainly not only have to spend for the damage to the other person's auto, but you will likewise have to pay for the damages to your own lorry out of pocket.

Examine This Report about Auto Insurance Shopping Guide - Illinois.gov

by Valerie Hawkins Opportunities are, if you possess a cars and truck, and also you're an obedient citizen, you have car insurance. And also although car insurance is one of the most usual types of insurance coverage available there are a whole lot of icky, confusing terms that accompany it. Do not let insurance mumbo-jumbo obtain you overwhelmed.

In some cases, when you have extra concerns than answers on complex insurance terms, it might seem less complicated to do absolutely nothing at all. It is feasible to purchase even more insurance coverage defense than the minimal level of coverage called for. Liability insurance policy protection secures you only if you are liable for a crash and also pays for the injuries to others or problems to their building. insure.

Excitement About Types Of Car Insurance Coverage & Policies

what does car insurance cover

what does car insurance cover

What various other kinds of coverage can I purchase? Chauffeurs that intend to protect their lorries versus physical damage can need to buy: This protection is for damages to your vehicle resulting from an accident, despite that is at mistake. It offers repair service of the damages to your car or a financial repayment to compensate you for your loss.

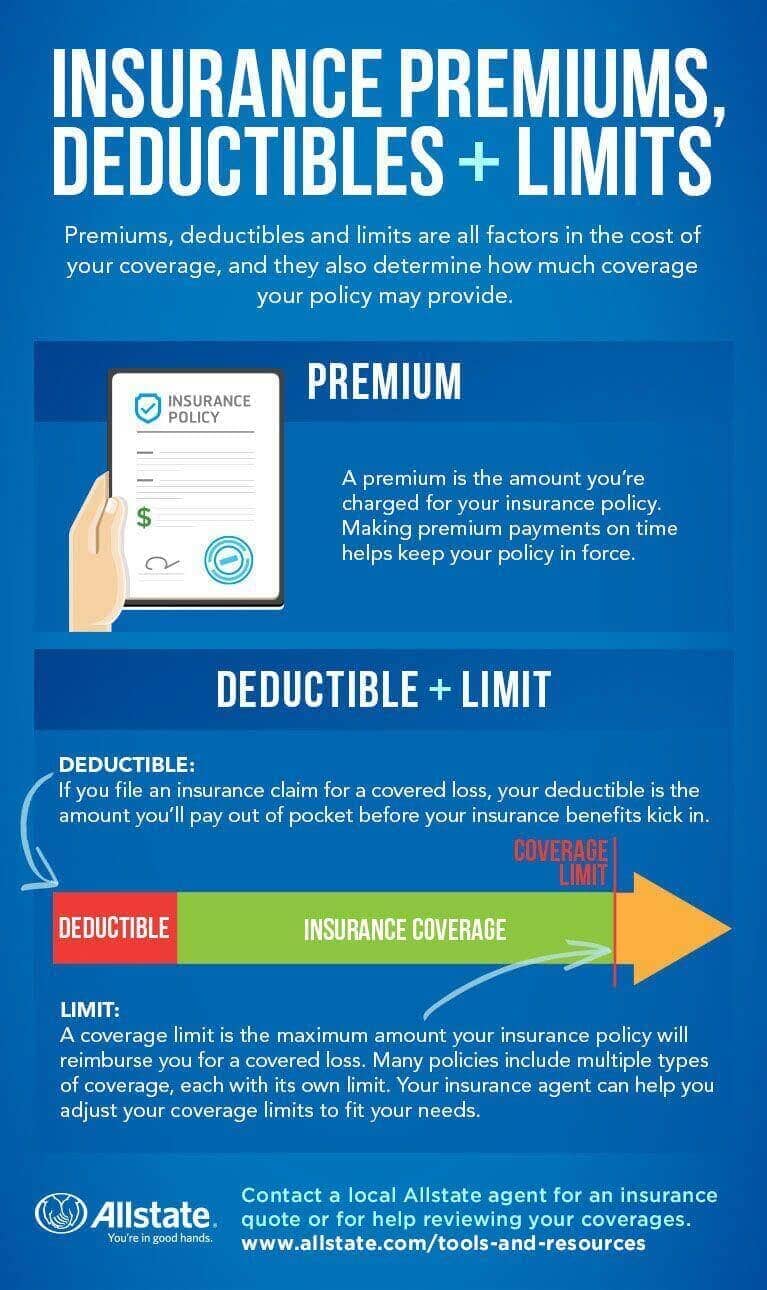

It likewise pays for dealing with injuries resulting from being struck as a pedestrian by a motor lorry. Your vehicle insurance policy deductible is the quantity of money you should pay out-of-pocket prior to your insurance policy compensates you.

You have a Subaru Wilderness that has Crash Protection with a $1,000 deductible. In this situation, you would pay the body shop $1,000.

As soon as you have actually fulfilled your $1,000 insurance deductible the insurance firm will certainly pay the staying $5,500. Just how does my insurance deductible influence the expense of my insurance policy?

Which Types Of Car Insurance Do You Need? - Nerdwallet Things To Know Before You Get This

When purchasing insurance coverage, the Division of Insurance suggests that you look for the recommendations of a qualified insurance policy professional. There are 3 types of specialists that generally market insurance policy: Independent agents: can sell insurance policy from several unaffiliated insurance firms.

Despite what kind of expert you select to make use of, it is essential to validate that they are certified to conduct service in the State of Nevada. You can inspect the permit of an insurance policy expert or company right here. Bear in mind Constantly validate that an insurer or agent are licensed prior to providing personal info or repayment.

what does car insurance cover

what does car insurance cover

These aspects include, however are not restricted to: Driving record Insurance claims background Where you live Sex and also age Marriage Condition Make as well as design of your car Credit scores Nevada has among one of the most affordable and also healthy auto insurance coverage markets in the nation. Buying for insurance coverage might permit you to attain competitive pricing (auto insurance).

To discover making use of your credit report info by insurance coverage business read our Regularly Asked Questions Concerning Credit-Based Insurance Policy Scores - cheap car insurance.

How Things To Know About Car Insurance And Rental Cars Before ... can Save You Time, Stress, and Money.

what does car insurance cover

what does car insurance cover

Whether or not you are covered will differ policy to policy The Hanover's Platinum Car Elite makes sure you're covered (cheaper). Will my auto insurance policy pay for a rental if my vehicle is in the store? Your vehicle insurance policy will pay for the price of a leasing just if you chose rental reimbursement protection in your policy.

What's the difference between responsibility and also complete insurance coverage insurance coverage? Obligation coverage auto insurance insures against the damages you can cause to other individuals or their residential or commercial property in the event of a mishap for which you are at mistake. Full coverage automobile insurance coverage consists of obligation, however additionally consists of accident and also thorough coverage.

Picking the ideal insurance policy is a large choice, and you might have some vital concerns that need answers - cheapest. Of all the various kinds of car insurance policy, which use the best protection for you?

Getting The How Does Car Insurance Work? - Investopedia To Work

A tree dropped on your brand-new automobile during a hefty tornado, and currently it's a wreck. car. You need a tow vehicle and also a leasing, plus your auto requires to be repaired or changed. Time to call the insurance policy business. Good idea you have full coverage vehicle insurance. Or do you? Regardless of the appeal of the term, there is no such point as full coverage vehicle insurance.

When you inform your insurance agent you want full insurance coverage, it's simple to assume you have every insurance policy protection offered. If you want to be totally covered, consider adding these: Without insurance as well as Underinsured Vehicle Driver Insurance: This coverage pays for your cars and truck repairs when the person who triggered the crash can not pay (credit score).

When Full Protection Does Not Totally Cover You Visualize you created a mishap, as well as the cars and truck you struck was a deluxe sedan. Two of the guests were moved to the healthcare facility with deadly injuries. insurance companies. After the accident, you may find that you have the right kind of insurance, just insufficient of it.

Cars and truck insurance policy protects you monetarily by paying expenses that you sustain in a collision, or if your car is harmed or stolen. While your insurance coverage policy is energetic, your automobile insurance provider will pay for damages to your automobile, your medical expenses as well as damages to others that you are accountable for, as long as the case is covered by your policy - insurance companies.

The 9-Minute Rule for 5 Types Of Car Insurance Coverage Explained - 21st.com

The majority of the premium you pay your insurer goes towards covering other individuals's cases, with a smaller part of it covering your insurance provider's operating expenses. This includes the cost of adjusting as well as paying insurance claims, and setting premiums by analyzing exactly how likely its consumers are to get in a crash or sue.

What is vehicle insurance coverage? Vehicle insurance coverage covers the cost of damages when an automobile mishap takes place.

Physical damages to your vehicle or another cars and truck - car insurance. Damages to your residential or commercial property or somebody Helpful hints else's home, like a cell phone or fence. No matter just how risk-free as well as skilled a driver you are, you can not manage elements like the weather, the state of the roadways or the activities of other individuals.

Obligation vehicle insurance policies integrate 2 different kinds of insurance coverage: Physical injury (BI) Property damages (PD) covers any prices that emerge from bodily injury to the other party, varying from funeral expenses or shed incomes to medical and dental bills. covers the expenses of repair work to or replacement of the various other party's home harmed in a mishap, whether that is their cars and truck, house or a few other things.

What Does Car Insurance Cover? - Dairyland Auto® Things To Know Before You Get This

Called "split limitations", these numbers represent the maximum amount your insurance company will pay to cover: Bodily problems to one individual. Physical damages to all individuals associated with the crash. All residential property damages caused to others in an accident. Each state sets. If you drive without insurance policy that meets these minimum limitations, you might be subject to penalties and even jail time.

Physical damages auto insurance coverage, by comparison, covers the price of damage to your automobile. There are 2 kinds of physical damage auto insurance:: spends for damages to your vehicle if you are at fault in a crash. If it's unclear that is at fault, crash protection will certainly still pay for your repairs.

This damage could arise from theft, criminal damage or natural calamities. In spite of what its name indicates, nonetheless, detailed auto insurance coverage does not cover every little thing. Individual items swiped out of your cars and truck, for example, are not covered. While accident and also comprehensive insurance coverage are both optional, we recommend buying them both. If you do not have this insurance coverage, you will be accountable for the complete cost of repair services to your vehicle after a crash.

Accident defense and also Medication, Pay Injury protection (PIP), also recognized as "no-fault insurance coverage", pays medical bills for you and also your guests after a mishap. It is commonly called no-fault insurance policy since your insurance firm pays no matter who is at fault in a mishap. Some PIP insurance policy covers lost salaries, household and also childcare expenses, as well as funeral prices.

Some Ideas on Does Automobile Insurance Follow The Car Or The Driver? You Should Know

https://www.youtube.com/embed/YishXEDRqyAOne more choice that. Similar to PIP, Med, Pay just covers clinical as well as funeral expenses and usually does not cover shed incomes, psychiatric care or rehabilitative care, as PIP does. Uninsured/underinsured driver coverage If the other vehicle driver is at mistake in a mishap, their liability insurance need to cover your repair services - prices.

Car Insurance Deductibles - How Do They Work? - 21st.com for Dummies

Edit your About page from the Pages tab by clicking the edit button.

All About What Is A Car Insurance Deductible? - Promutuel Assurance

Edit your About page from the Pages tab by clicking the edit button.

Getting My Everything You Need To Know About Your Auto Insurance ... To Work

Edit your About page from the Pages tab by clicking the edit button.

A Biased View of No Deductible Car Insurance, Explained - Getjerry.com

Edit your About page from the Pages tab by clicking the edit button.

Little Known Questions About No Deductible Car Insurance, Explained - Getjerry.com.

Edit your About page from the Pages tab by clicking the edit button.

The smart Trick of What Is An Auto Insurance Deductible? How Does It Work ... That Nobody is Talking

Edit your About page from the Pages tab by clicking the edit button.

Get This Report about Gap Insurance - Wikipedia

Edit your About page from the Pages tab by clicking the edit button.

About What Is Gap Insurance? - Capital One Auto Navigator

Edit your About page from the Pages tab by clicking the edit button.

9 Easy Facts About Is Gap Insurance Worth It? - Automotive Tips At Audi Stratham Described

Edit your About page from the Pages tab by clicking the edit button.

The Ultimate Guide To Buying A Car: When Should You Buy Gap Insurance?

Edit your About page from the Pages tab by clicking the edit button.

Getting My Gap Insurance In Florida - Suncoast Credit Union To Work

Edit your About page from the Pages tab by clicking the edit button.

An Unbiased View of Gap Insurance: Do You Need It? - Money Saving Expert

Edit your About page from the Pages tab by clicking the edit button.

9 Simple Techniques For How To Choose The Right Car Insurance Deductible - Metromile

Compare quotes from the leading insurance provider - cheapest auto insurance. Key Things Concerning Cars And Truck Insurance Coverage Deductibles, If you have cars and truck insurance, you will need to pay an automobile insurance coverage deductible when you sue for repair work and also injuries. Just how much you spend for your deductible relies on your vehicle insurance policy protection and just how much your automobile insurance premium is.

The at-fault chauffeur in the accident is typically needed to pay an auto insurance coverage deductible. Responsibility insurance coverage does not need an auto insurance policy deductible, but just covers the costs of the other driver, not your very own. Concerning the Writer.

What is a vehicle insurance policy deductible? The deductible is the buck amount "deducted" from an insured loss. To put it simply, the deductible is the amount that an individual have to pay out of pocket for repair services or replacement after a mishap. For Example: let's claim you are in a minor car accident, the total cost of fixings is $1,000, and your insurer pays $800.

laws credit suvs perks

laws credit suvs perks

1 For several customers, figuring out just exactly how much of a deductible to take can be a difficult decision. How does an auto insurance policy deductible job?, although they might be the very same deductible amount. cheapest car insurance.

Comprehensive insurance coverage protects your car from theft and damage not created by a collision. The deductible on your policy will use if you sue for damages covered by extensive, nevertheless there are some circumstances in which you don't need to pay a detailed insurance deductible. Cracks or chips in your windscreen might be paid in full by your insurance business depending on the state you live in.

See This Report about Types Of Deductible In Car Insurance - Digit

credit vehicle insurance money auto insurance

credit vehicle insurance money auto insurance

Any claim you apply for damage that is covered by crash will undergo an accident insurance deductible. 1 The greater an insurance deductible, the reduced the yearly, biannual or month-to-month insurance coverage premiums might be due to the fact that the consumer is presuming a part of the total cost of an insurance claim. The deductible quantity will come out of the insurance policy holder's pocket in the occasion of an at-fault car crash, which could overshadow the costs cost savings.

If the policyholder does not have an at-fault crash causing an insurance claim, the person has actually paid even more for vehicle insurance policy than someone with a higher deductible. When do you pay the deductible for auto insurance coverage? A better inquiry could be, when do you not need to pay the vehicle insurance coverage deductible? For the most part you're on the hook for it, nonetheless if you're in a mishap which one more chauffeur is at fault for, this is not the situation.

This is only the instance as long as the costs fall within the variety of the protection you acquired, nevertheless - risks. A diminishing insurance deductible may inevitably lead to a lowered insurance deductible or even none at all. This sort of deductible benefits drivers for avoiding crashes by decreasing their insurance deductible annually they continue to be accident-free.

A high deductible will reduce your total insurance price, nevertheless it will certainly raise your out-of-pocket costs if you submit a case. 1 Five concerns to help you select the appropriate automobile Click for info insurance coverage deductible In identifying the best deductibles, below are five inquiries to take into consideration prior to making the decision: Exactly how do various insurance deductible degrees influence the insurance premium? This is a good question as no 2 insurance policy business will certainly have the same deductible-premium ratio, and also states differ on their regulative technique to the topic - car insurance.

That $800 now appears of the proprietor's budget. Nonetheless, if the proprietor had a $100 deductible, the out-of-pocket expenditure would be just $100, offering a cost savings of $700. Is it better financially to have a reduced deductible and a greater premium? That depends. Someone with a low deductible/higher costs ratio can undergo a 10-year duration without filing an insurance coverage case.

Getting My Automobile Insurance Information Guide To Work

How does a person's driving record impact the choice of deductible? The current reasoning is the cleaner the driving document, the higher the factor to consider one should provide to a greater deductible as it will certainly decrease costs (vans). On the various other hand, for somebody with a less-than-clean driving record, the person should consider taking a lower deductible, regardless of the additional premiums.

The policy premium is the expense you will certainly pay to an insurance coverage company for providing the policy protections as well as features provided in the policy. This is a repeating fee to keep the plan, although it will likely alter at your renewal period based on the firm's upgraded prices as well as your individual metrics.

Your insurance deductible amount is something you will determine with your insurance agent or service provider before completing your vehicle insurance coverage policy. cheap. You need to have the choice to change your deductible at any kind of time.

However other protections such as extensive, crash, personal injury protection and also uninsured motorist residential property damage exist to help cover injuries to those in your automobile and also damage to your auto. These coverages might have deductibles, or a minimum of the alternative to include a deductible to lower the cost of protection.

g., utility pole, guard rail, mailbox, structure) when you are at-fault. While collision coverage will not repay you for mechanical failure or regular wear-and-tear on your car, it will certainly cover damage from craters or from rolling your automobile. The average price of accident coverage is typically around $300 per year, according to the Insurance coverage Details Institute (Triple-I).

Unknown Facts About Understanding Auto Insurance

ComprehensiveOptional comprehensive protection gives security versus burglary and also damage to your car triggered by an event apart from a collision. This consists of fire, flooding, criminal damage, hail, falling rocks or trees and various other risks, such as hitting a pet (car). According to the Triple-I, the typical price of comprehensive coverage is normally much less than $200 per year.

This insurance coverage is not available in every state, however it might have a state-mandated deductible amount in those where it is (cars). In cases where an insurance deductible uses, it is generally low, between $100 to $300. Accident protection, Relying on your state, you may have accident security (PIP) protection on your plan.

It can additionally aid cover expenditures related to shed salaries or if you require somebody to do household tasks after a mishap due to the fact that you can refrain from doing so - laws. Depending upon your state, you might have an insurance deductible that applies if submitting an insurance claim under this coverage. Several states with PIP deductibles provide several choices to pick from, and the deductible you choose can influence your costs.

A lot of business provide options for $250, $500, $1,000 or $2,000 deductibles. Some car insurance policy business provide different alternatives for deductibles, consisting of a $0 or $100 deductible. Your detailed and also crash coverages do not have to match, either; it is not uncommon to have a $100 thorough deductible yet a $500 accident insurance deductible, or a $500 thorough insurance deductible as well as $1,000 collision insurance deductible - vehicle.

Usually, the lower the insurance deductible, the greater your insurance policy premium. It is very important to consider your overall financial health when choosing an insurance deductible. Variables to take into consideration when choosing a car insurance policy deductible, There are several points to take into consideration when picking your auto insurance policy deductible quantity. We have covered several of them here: Do you desire to pay less for cars and truck insurance or repair work? A greater deductible will usually lower your insurance costs, however you will certainly pay greater out-of-pocket costs if you file a case for damage to your car.

What Is An Insurance Deductible? - Ramseysolutions.com Things To Know Before You Buy

You can spend extra on your premium by having a reduced insurance deductible and also never finish up filing a case. Prior to you pick a deductible, it is vital to figure out what you can pay for to pay if your car is damaged in an accident.

insurance company affordable auto insurance dui vehicle

insurance company affordable auto insurance dui vehicle

If you do, you may not be able to manage to repair your automobile if you are at fault and also require to pay the insurance deductible for repair services. Does your lender have deductible requirements? If your vehicle is funded or rented, you will possibly need to bring detailed and also crash coverages for your car.

Some lending institutions will certainly have a maximum deductible that you are allowed to carry for comprehensive and also collision. It is essential to contact the banks that manages your car loan or lease to determine if these limitations exist. When are you not needed to pay your auto insurance deductible? There will certainly be celebrations when you are not needed to pay your insurance deductible, however those are infrequent.

Your deductibles just apply when submitting a claim with your insurance company. If you have a reducing insurance deductible, Some insurance provider provide a lessening insurance deductible, or disappearing deductible, option. If you have this plan function, the longer you do without a crash results in a decrease in the quantity you would certainly need to spend for your deductible.

So, as an example, if you have a $500 collision insurance deductible and also do not have an accident for 4 years, you could get a $100 reduction every year - risks. If you needed to file a case, your deductible would certainly be $100 instead of the original $500. As soon as you use your lessening deductible, there is typically a period to get approved for it once more.

Getting The What Are Auto Insurance Deductibles & How Do They Work? To Work

Regularly asked questions, What does it suggest when you have a $1,000 collision deductible? If you have a $1,000 insurance deductible, you will certainly pay $1,000 expense if you have actually an accepted insurance claim covered under collision. If you submit a claim for $5,000 worth of fixings, you will certainly pay $1,000 and also the insurance coverage firm will pay $4,000.

Your physical injury obligation as well as home damage obligation will certainly pay for the problems to the other event, and also those coverages do not have a deductible. However if you have accident protection and also you desire the insurance coverage firm to tip in to cover the repair services to your lorry, you will certainly have to pay your collision insurance deductible.

If the crash was the various other vehicle driver's fault, their responsibility coverage should spend for your problems and also you need to not have to pay an insurance deductible. Nonetheless, if the other vehicle driver is without insurance or underinsured, you might be in charge of paying an insurance deductible depending upon how your protection puts on cover the expenses.

Your insurance provider will spend for your damages, minus your insurance deductible, and after that ask the at-fault motorist's insurance company to pay the cash back in a process called subrogation (low-cost auto insurance).

It's the most typical insurance coverage inquiry: Unfortunately, the solution is never reduced and also completely dry. While elevating your deductible will certainly reduce your costs, there are other results to think about for your automobile insurance policy expenses. Allow's take a look at all the aspects you must consider when selecting your car insurance coverage deductible! What is a deductible? A is the quantity you pay out of pocket when you make a case.

Indicators on What Does Deductible Mean In Car Insurance? - Car And Driver You Need To Know

dui auto cheapest auto insurance credit

dui auto cheapest auto insurance credit

If you weren't called for to have a deductible, you can practically have as several mishaps as you wanted on the insurance provider's cent. Paying a deductible ensures you also have a stake in any kind of cases you make. Deductibles normally only relate to harm to your own residential property, like whens it comes to thorough as well as accident vehicle insurance (insured car).

https://www.youtube.com/embed/IAJ6inGNcXk

What is the relationship in between the deductible and costs? Usually, a reduced insurance deductible ways greater regular monthly settlements. If you have a low insurance deductible, you have a lot more coverage from your insurer and you have to pay much less expense when it comes to a claim. A greater insurance deductible suggests a reduced expense in your insurance policy costs.

Total Loss Auto Claims With Your Insurance Company - Illinois ... Fundamentals Explained

cheapest car insurance accident low cost cheaper car insurance

cheapest car insurance accident low cost cheaper car insurance

GEICO and also other insurance providers likewise use their own assessment software throughout this action of the process. Determine the cost to fix your damaged car First, your insurer will link you with an insurance claims adjuster. They will then examine the damage to your automobile as well as approximate the fixing prices. Just like just how insurance companies make use of software program to determine an automobile's value, they use software to establish repair prices, as well.

In several states, the total-loss threshold is 75%, which is sometimes referred to as the ratio. As an example, let's claim your car deserves $20,000. If the expense to repair the problems is $15,000 or higher, your automobile is amounted to. If the damages are less than 75% of the vehicle's market value, it's fixable.